In the competitive world of mobile gaming, marketability testing is crucial for ensuring the success of your mobile game launch. This blog post delves into the importance of collaboration between marketing teams and game developers, outlining the various stages of marketability testing and providing actionable insights to help you create a successful mobile game. From industry trend analysis and competitive analysis to user research, feature and art style analysis, and concept testing during soft launch phases, this article can guide you through the process of optimizing your mobile game’s marketability, ensuring your game reaches its target audience and stands out in the crowded marketplace.

Stage 1: Analyze industry trends together with marketing

A great starting point for closer collaboration is a joint and ongoing effort between game developers and game marketers to stay informed about industry news and trends, and share relevant information with each other.

There are many resources available to help you stay up-to-date on industry trends and developments. These include websites and blogs such as PocketGamer, TouchArcade, IGN, GamesIndustry.biz, Gamezebo, and Deconstructor of Fun, as well as international conferences such as GDC, PGC, MWC, ChinaJoy, and Tokyo Game Show.

The app stores are also a valuable source of information about industry trends. Simply keeping an eye on the top-grossing rankings, most downloaded rankings, and top movers/download trends in the gaming sub-categories are a great way to analyze where the market and the competition is headed. This data can help you to identify potential opportunities and challenges at the ideation phase.

Stage 2: Conducting a competitive analysis for a game idea

It’s fiercely competitive out there and ideas for new games often originate from existing games or mechanics that are fun for the user and successful in the market. When you have ideas for a new game in mind, it is highly advisable to already go deeper into a competitor analysis. This should be conducted by marketing before any game development takes place, to indicate whether the idea has potential.

To build a competitive landscape for a game idea there are typically four steps:

- Identify competitors. You can do this by searching for apps in the same category as your game would be, analyze keyword rankings for these competitor’s unique selling points (USPs), and look at the similar or recommended apps of identified competitors. Tools such as GameRefinery can be very helpful in this process.

- Gather data on competitors. The next step is to gather data on competitor’s performance in the market. This can include metrics such as downloads, revenue, and review analysis. Tools like Apptweak, data.ai, SensorTower, or Mobile Action offer estimates on these metrics and analyze reviews for you automatically.

- Analyze competitors. Once you have gathered data on your competitors, the next step is to analyze this information to understand their strengths and weaknesses, compare target audiences, gameplay mechanics, USPs, visual style, and key game features.

- Assess market dynamics. Answering the following questions can help you to understand the dynamics of the market and identify any potential barriers to entry:

- Do competitors get high traffic quickly? If yes, the market may be dynamic and has potential for high traffic?

- Alongside big and small competitors, is there also a middle layer? If yes, the market may be large and has potential for high traffic. If the answer is no, the market may be niche.

- Are all competitors old and well-established? If yes, there may be high entry barriers. If no, there may be potential for high traffic.

- Is the share of big intellectual property (IP) low among competitors? If yes, there may be potential for high traffic. If no, there may be high entry barriers.

Stage 3: User research for mobile games

With an understanding of the competitive landscape and the market dynamics, the ultimate positioning of your game should become clearer. Now it’s time to ask your would-be users what they think.

Conducting player surveys can now help to dig even deeper into understanding and identifying further market opportunities. One place to start is to survey your existing audience using tools such as Google Survey or SurveyMonkey.

Alternatively you can find users to interview or conduct focus groups with, using resources such as your own company network, targeted ads, or third-party tools like Playtestcloud. You should also consider offering incentives to encourage players to participate in your survey, and give full answers.

It’s very important to ask the right questions and structure your surveys in a way that yields tangible insights that can assist game development at this point. See here for our instructive guide on how to do this effectively.

Stage 4: Assessing marketability by analyzing features, setting, and art style

As the game enters the production phase, it is likely it quickly takes on defined features, one or a few possible settings, and one or a few directions for the art style. These can be assessed for marketability as they take shape to ensure the game’s development remains on the right track.

Game features and settings

The game’s features alongside the unique and/or innovative gameplay mechanics can be a major factor in a player’s decision to download the game. The same can be said for the setting of the game. Standing out from the competition without being too polarizing is a balance, and one marketing can help with by asking critical questions of the game developers.

- Is the amount of clear USPs high? If there are no or very little unique selling propositions, it’s best to rely on best practices and/or what competitors are successful with.

- Is the gameplay, the setting, and the story easy to explain?

If it’s difficult, adding explaining elements such as icons or texts to your marketing assets can help to make the marketing assets clearer and faster to grasp. - Is the setting unique (ie not forgettable, generic, looking like other games)?

- Are there features with potential for virality?

- Is the current pop culture fit high?

- Does the setting limit the audience heavily (Who would not click?)?

Quality of the assets

Looking ahead to what the graphic assets of the marketing material will look like is also a valuable exercise at this stage, for example in the videos or on screenshots to appear on the app stores on mobile devices. Some guiding questions for this process are as follows:

- Are the assets clear, easy to read and adaptable to a variety of formats?

Review the assets keeping in mind that the game’s mobile marketing will need to sell the product in seconds. - Are the assets visually appealing?

High-quality assets can help convey the game’s visual style, themes, and gameplay mechanics to potential players, as well as help create a strong and memorable impression. Poor-quality assets, on the other hand, can damage the credibility and appeal of the game. If the quality of the assets is low, consider overpainting or polishing the assets for marketing purposes. - Are there strong, diverse, and emotional characters?

Characters can be a powerful tool for marketing, however if they are not a good fit for the audience test going forward without focusing on characters on your marketing material. - Are the platforms (Google, Apple) likely to be enthusiastic about this game? You can read our introduction to just how impactful featuring on the app stores can be here.

- Do the assets spark ideas for social media (ads)?

Stage 5: Concept testing for your game and the soft launch phase

If your mobile game has made it this far in development, it’s now time to collect real user data and properly test creative concepts. This usually starts during the production phase and is ongoing until the global launch.

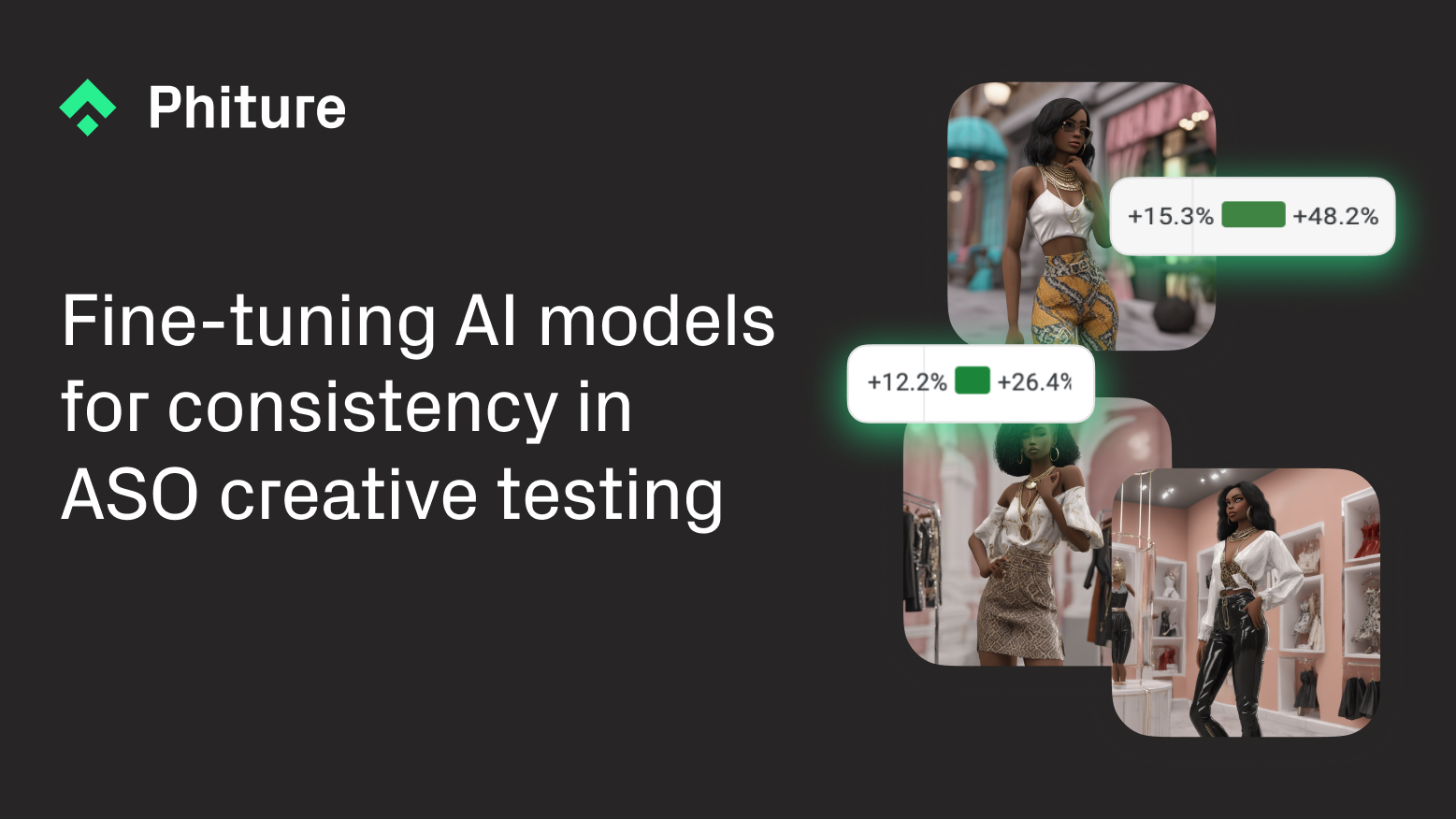

Third-party app stores, like Phiture’s own Replika, are a great tool to test the early funnel from impression to install, and will also give a good indication of CPIs later on.

Replika simply simulates the app store page (App Store and Google Play) on the users’ browser in order to test icons, screenshots, descriptions, or any other asset. They also provide insights into user behavior, including information on which elements of an app store listing are most likely to drive downloads.

This can help developers identify which elements are most effective at communicating the game’s appeal to potential players. When using Replika, another great page to direct these users to is a survey that additionally qualifies user interest in the game.

Questions like the following can give additional insights with Replika:

- How often do you play mobile games?

- What types of mobile games do you typically play?

- What factors influence your decision to download a new mobile game?

- What interests you most about the game you have just seen?

- Are you likely to recommend our mobile game to your friends or on social media?

Besides access to the Replika tool and the ability to send traffic to the pages via Meta or TikTok ads, the requirements for such a test are two to three concepts with ads (static, video, or animated statics), some headlines and texts, as well as titles, icons, subtitles, 2-3 screenshots, descriptions for the store page.

To find out more about how Replika can help you with your concept testing, you can contact us here.

Technical Soft Launch

The technical soft launch is typically the first time users are being sent to the game through paid User Acquisition (UA). The focus here is on technical stability, First Time User Experience (FTUE), or day 1 retention. During this phase, it’s important to test a range of different creative directions and keep an eye on ratings and reviews. While the goal is not to achieve your desired performance marketing KPIs, it’s worth looking and evaluating the preliminary CTR, CVR, and CPM or CPI, however limited the data might be.

Soft Launch

The soft launch can range from a few months when the game is far into production, up to many months – or even years – if issues occur or the market fit is weak. The goal is to test the longer-term retention as well as monetization versus the acquisition costs of users. It depends on the product whether a soft launch is better done in waves of user acquisition or a constant flow of traffic.

ASO can deal well with waves as long as they are well-aligned with experiments (e.g. bring 2000 new players in 1 week). Paid UA, on the other hand, can be more sensitive to waves of traffic. Some channels, such as paid social (e.g. Meta, TikTok), are quicker to learn and adjust to changes in traffic compared to others, such as Google Ads (GAC). Additionally, paid social is better for testing creatives.

Keep in mind that for Creative Teams it can be suboptimal to work in sprints when doing waves as they need to remain flexible for emergency tasks and react immediately to performance to not waste traffic when it’s being acquired.

Selecting soft launch markets

Choosing the right markets for a mobile game’s soft launch is an important step in the process. There are several factors to consider when deciding which countries to target, including acquisition costs, the distribution of operating systems and OS versions, the size of the market, the relevance of the market to the target audience, localization considerations, and regulatory considerations.

Ultimately, the best countries for a soft launch will depend on the specific needs and goals of the game and the target audience. Here are some examples:

- The Philippines are mostly cheap for UA and typically suitable for technical tests

- Eastern European markets, for example Poland, are often relatively cheap in user acquisition but considered culturally close enough to Tier 1 EU markets such as Germany, France, and the UK.

- Nordic countries and the BENELUX region are culturally close to DE, FR, UK and don’t require localization as most people are used to English language media and games. The markets individually are too small to run reasonable tests so some of these countries are usually combined.

- Canada is often used as a proxy for the US market and thus the focus towards the global launch for marketability testing.

Conclusion

In conclusion, the key to successfully launching a mobile game lies in the close collaboration between marketing teams and game developers throughout the development process. By staying informed about industry trends, conducting a thorough competitive analysis, engaging in user research, assessing features and art styles, and effectively testing your game concepts during soft launch phases, you can optimize your game’s marketability and increase your chances of success. Remember that staying adaptable and responsive to market changes, user feedback, and performance metrics is crucial to achieving long-term success in the competitive mobile gaming landscape. By following the guidance provided in this blog post and continually refining your marketing strategies, you’ll be well on your way to creating a mobile game that captivates and engages players around the world.

Before you go:

- We recently launched Replika, a third-party app stores test environment, that lets game developers test app or game concepts before development or release. In this article we explore how game developers can work with their Marketing Teams to factor in a game’s marketability throughout the process of game development.

- We can help you with this process by performing App Store Research, and surveying your would-be players. Reach out to us here with details about your game and we’ll be in touch.

- Our app store test environment Replika lets you test app and game ideas, designs, and concepts — before development. Reach out for a demo here.

- Already launched your game? Find out more about how you can motivate gamers to install your app via creative optimization.